Every pastor knows that a growing congregation is a blessing, but it can come with challenges, too — like space. What happens when a church outgrows a building’s capacity?

WatersEdge is helping answer that question in Tennessee thanks to a partnership with The Tennessee Baptist Foundation (TBF). Based in Oklahoma City, WatersEdge is a nonprofit, Southern Baptist financial services ministry. The organization has worked to meet church financing needs across the Volunteer state for the past three years as TBF’s preferred loan provider. For Bill Gruenewald, TBF president and treasurer, the alliance with WatersEdge is strategic, especially in light of high inflation and other economic pressures.

“We partnered with WatersEdge because we wanted to be a better financial resource for Tennessee Baptist churches during these challenging times,” Gruenewald says. “WatersEdge specializes in church loans, and they can handle financing from $10,000 to $10 million and beyond.”

Gruenewald adds that the impetus for the partnership came from a growing chorus of Tennessee churches that contacted TBF in need of financing.

“When I came into this role, we were making a few loans out of our endowment, but our maximum was about $500,000,” he remembers. “These days, you can’t build or remodel much of a building for $500,000, but people were often coming to me needing $1 to $5 million, or more.”

WatersEdge stepped into the gap, offering compelling rates that could compete with — and often beat — most for-profit lenders. With more than 65 years of ministry financing experience and active loans in 25 states, WatersEdge provides funding for a wide variety of projects including new buildings, renovations, refinancing, land or property acquisition, and even small loans. The organization’s seasoned staff is ready to guide churches through what can often be a confusing process.

“Our goal is to streamline financing for churches, giving personalized service and reducing the mountain of paperwork required by most banks,” says Bobby Hart, president of WatersEdge Ministry Services. “We walk alongside churches, making sure we understand their unique vision and ministry goals.”

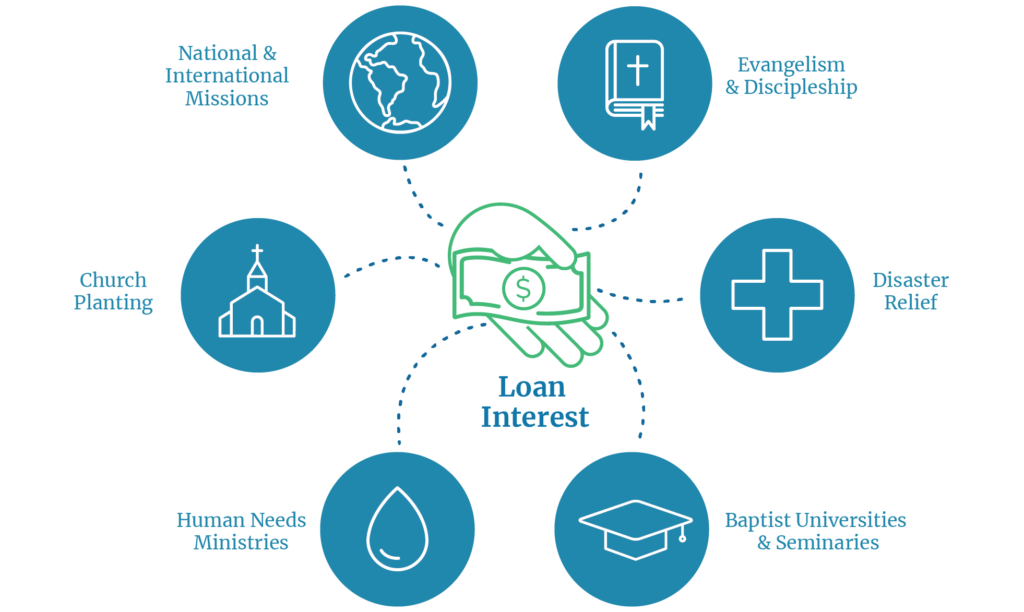

But there’s an even better reason for Tennessee Baptist churches to utilize WatersEdge: the vast majority of interest paid on a church’s loan is reinvested in Kingdom causes — often supporting other Southern Baptist churches.

“That’s what makes us unique,” Hart says. “When churches partner with us in the loan process, they can be sure that even the not-so-fun part — the interest they’re paying — is used to fund Kingdom work and spread the Gospel.”

This emphasis is one of the primary reasons the Tennessee Baptist Foundation chose WatersEdge as its preferred lender. Gruenewald is quick to point out that the partnership aligns well with two of the state convention’s priorities for the new year.

“Revitalization and church planting are two of the Five Objectives of the convention. We’re trying to help revive some of the smaller churches, bring back some life. And we’ve been successful,” he says. “We’ve also got a lot of churches that are starting new ministries — in their area, in another part of the state, or even around the world. WatersEdge can help, because these ministries often need to either update their facilities or build something new.”

Sometimes, renewal can come through something as simple as refinancing. That was the case for John Rollins, pastor of Simeon Baptist Church in Antioch, Tennessee.

“We were blessed because WatersEdge was able help our church refinance at a critical time in our history,” Rollins says. “With a lower interest rate, we have been able to reduce our debt at an accelerated rate so we can look forward to doing more ministry in the future. WatersEdge was professional, patient, and pleasant to work with.”

Gruenewald says the TBF-WatersEdge partnership is a no-brainer for churches looking to build. “When you go with WatersEdge to fund your loan, you’re doing a couple of things,” he says. “First, you’re working with an organization that understands Baptists because they are Baptists. And second, the interest you’re paying on that loan is not going to a bank’s bottom line. It’s going back to ministry to spread the Gospel. It’s as simple as that.

For more information on funding your project, visit our loans page.

By Kedrick Nettleton