In 1966, The Beatles put into song how seniors often feel when receiving a Required Minimum Distribution (RMD) from their traditional Individual Retirement Account (IRA): “If you drive a car, I’ll tax the street. If you try to sit, I’ll tax your seat. If you get too cold, I’ll tax the heat. … ‘Cause I’m the taxman, yeah, I’m the taxman.”

Most of us are like George Harrison — we want to minimize taxes! And while traditional IRAs are an excellent way to save for retirement, paying the income tax associated with withdrawals can feel frustrating. Thankfully, Congress recently enacted changes that can help you avoid income taxes, maximize your ability to provide for yourself, and support Kingdom Work — all through a Charitable Gift Annuity, or CGA, for short.

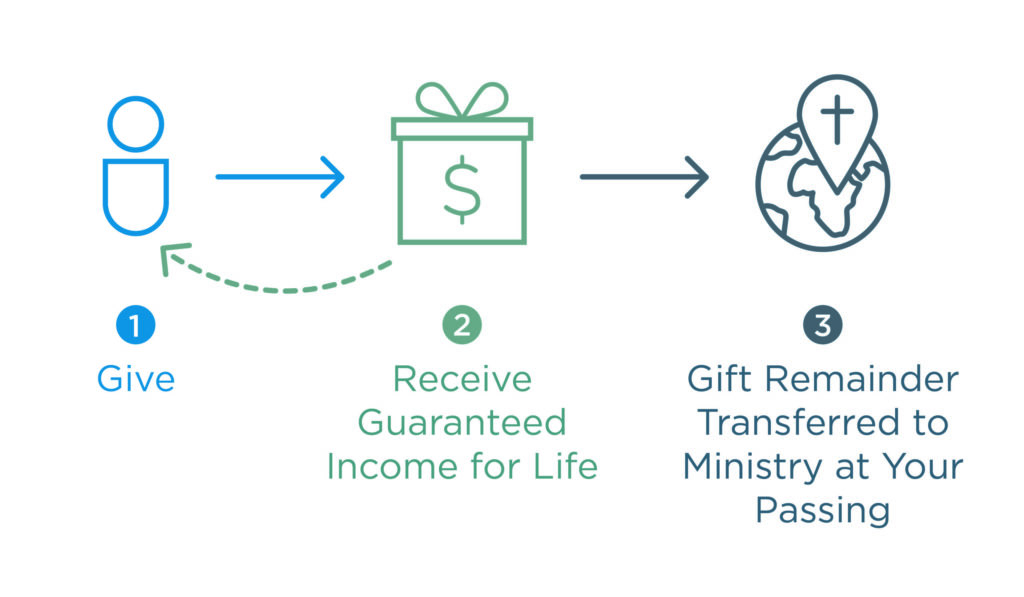

In case you’re not familiar, a CGA is a charitable giving tool that allows you to make a gift to ministry while simultaneously receiving tax benefits and guaranteed lifetime income. After your passing, the remainder of your gift is used for the ministry’s benefit.

Here are three great reasons to consider giving through a CGA in 2023:

1. Receive Dependable Fixed Payments for Life

Regardless of economic uncertainties or market conditions, CGAs pay the same fixed amount each year for your lifetime — and, if desired, your spouse’s lifetime. Today, when many consider a recession a possibility or even a probability, these gifts are an excellent option for retirees looking for a reliable source of income that will not fluctuate with changing market conditions.

2. Lock in the Highest Available Rates in Decades

Last year, the American Council on Gift Annuities raised payment rates — not once, but twice! This means seniors can receive nearly unprecedented returns from their CGAs, from 5 percent to as high as 9.7 percent. These rates significantly exceed those of CDs, and CGAs have the added ability to advance God’s Kingdom with a gift to ministry after your passing. Use the CGA gift calculator at www.WatersEdge.com/calculator to get your customized rate today.

3. Fund a Charitable Gift Annuity Directly from Your IRA

If you own a traditional IRA and are age 70½ or older, you’re eligible to make Qualified Charitable Distributions (QCDs), also known as IRA Charitable Rollovers. A QCD satisfies your Required Minimum Distribution (RMD) and is excluded from your taxable income.

To reap the benefits of a QCD, don’t withdraw funds personally because those funds will be taxable. Instead, instruct your financial institution to send a check or wire funds directly to WatersEdge to benefit your ministry of choice. WatersEdge has team members on standby to help you facilitate this process.

The tax advantages of CGAs are even more enticing for those over age 70 ½. For the first time in history, the recent passage of the SECURE Act 2.0 enables givers to make a one-time QCD from an IRA to fund a CGA. You are eligible to transfer up to $50,000, and spouses can combine their separate $50,000 QCDs into a single CGA. CGAs funded from other assets qualify for a tax deduction; however, since IRA assets are not subject to tax when transferred to the CGA, the annual payments to the giver will be taxed as ordinary income.

Contact WatersEdge to Learn More

Your generosity enables WatersEdge to help facilitate Kingdom Work all over the world, and Charitable Gift Annuities (CGAs) are a strategic giving tool. Learn more about supporting ministry work through a CGA by contacting us today.

give@WatersEdge.com | 800-949-9988 | WatersEdge.com/give

By Christa Rogers